Calculating Spousal Support Payments Made Simple

Complete the fields below and press calculate to estimate alimony.

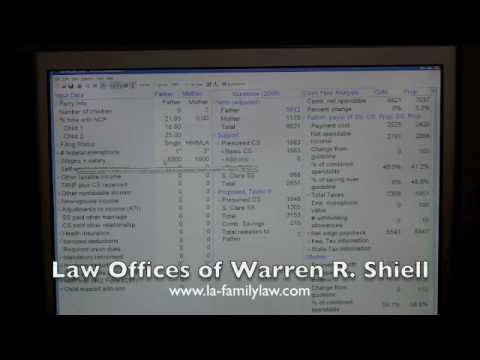

Family Law Records Requests - Effective May 3, 2021. The Family Relations Courthouse remains closed to the public, but is accepting limited appointments effective immediately for public viewing of case files for persons with critical needs to view or obtain copies of documents. DissoMaster software is used by family law professionals in California to calculate child support and spousal support payments in divorce cases. The Superior Court of California has relied on DissoMaster in divorce cases for more than two decades. DissoMaster™ Suite is the premium software bundle for computing support calculations under the California Statewide Uniform Child Support Guidelines. This software combines the most relevant tools for the family law practitioner or court in one simple-to-use suite of calculators. The “DissoMaster” is a program used by Los Angeles Superior Court, and many other courts, as well as the majority of family law attorneys to calculate child and spousal support. The DissoMaster computes child and/or spousal support based on the income of the parties, the timeshare with the children, and a variety of expenses and tax. What Is a DissoMaster Report? DissoMaster software is used by family law professionals in California to calculate child support and spousal support payments in divorce cases. The Superior Court of California has relied on DissoMaster in divorce cases for more than two decades.

The figures presented are based on legal California alimony guidelines. Please, complete all questions for the most accurate result.* Required fields

This calculator has not been approved by the State of California and is for estimation purposes only. Although we have thoroughly tested our calculator and believe it produces results consistent with the calculators that the courts use due to the use of the same mathematical formula, but there is no guarantee is made regarding its accuracy. We do not advise you to rely solely on this program in calculating support and do accept any liability from your use of the program.

This calculator does not constitute legal advice and is limited to estimation of spousal support (SS) and child support (CS) based on limited input. You should still consult a qualified attorney to obtain accurate legal advice regarding your specific child and/or spousal support rights and obligations. Only support calculations computed by certified software programs are admissible in court. This calculator is not certified or admissible for court use.

Our calculator uses the mathematical formulas found in the California Family Code and other Rules of Court and is current through the 2011 legislative session. The results of this program have been found to closely approximate results similar to officially approved programs.

Like all support calculators, the figures derived are only as accurate as the numbers input into the program. This calculator does not take into account all tax scenarios or consider all possible tax deductions. As such, our support calculations are not guaranteed. We make no warranty as to its accuracy or ability to match to other programs, either express or implied. In order to obtain as accurate of a support calculation as possible, you should consult a qualified family law attorney in your geographic area.

Where does this number come from?

Our calculator is based off the formula utilized by all courtrooms in California and is published in the family law statutes. The support figure that this calculator generates is commonly referred to as “guideline” and is typically what a courtroom will use to determine your monthly payment. A skilled attorney can argue to have this amount either raised or lowered depending on the situation. Cristin has established herself as an expert at this process and will fight to get you the best results. If you have additional questions on support or believe your numbers may be inaccurate, please give us a call or schedule a consult.

Are you ready to take the next step in your divorce?

Spousal Support Basics: What you Need to Know

The issue of alimony is part of every California divorce, regardless of length of marriage or employment status. The proper…

Understanding California Spousal Support Guidelines

Knowing your rights or obligations regarding spousal support is extremely important before filing for divorce. Learning why support is offered,…

Have children? Learn more about Child Support and Calculate Payments

Understanding California Spousal Support Guidelines

Knowing your rights or obligations regarding spousal support is extremely important before filing for divorce. Learning why support is offered, how long it will be paid, and exactly how much will need to be provided will help you be better prepared for what to expect. Here is a simple breakdown of the most basic and necessary information about spousal support.

What is Spousal Support?

- Spousal support, also known as alimony, is the term used for payments from one spouse to another after a divorce has been filed. It is broken down into two types: temporary and permanent. These terms are legal terms and not to be confused with the common definitions of temporary and permanent.

- Temporary support is spousal support that is ordered while a divorce is pending. It does not expire, nor is there a set period of time for support.

- Permanent spousal support is more accurately referred to as “post-divorce judgment” support. It is based on a set of 14 different factors, ranging from the length of the marriage to the marital standard of living.

What is the Purpose of Spousal Support?

- Temporary spousal support is to maintain the living conditions and standards of both parties until permanent support has been determined, along with the final division of assets and debts.

- The purpose of the permanent spousal support is different. It is to provide the spouse with sufficient income for their basic needs and to ensure that their lifestyle will be able to remain consistent after the divorce.

- It is the policy of the State of California that both parties become self-supporting within a reasonable amount of time. Spousal support is meant to bridge that gap between the time it takes for the supported spouse to obtain employment or resources that meet their cost of living needs.

How Long Will I Pay or Receive Spousal Support?

- The length of spousal support is based on a reasonable transition period from married life to single and self-sufficient life.

- The duration of support depends on in part on the length of the marriage. For marriages lasting less than ten years, the length of support is presumed to be equal to one-half of the time. For example, for a marriage that lasted eight years, the presumption is that the appropriate length of support is four years.

- If you are married for longer than 10 years, the lesser earning spouse will receive support for as long as he or she needs to, as long as the other spouse is able to pay. There is no automatic termination date.

How Much Spousal Support Will be Ordered?

- In California, the Superior Courts of Solano counties have adopted a spousal support guideline called the “Santa Clara Guideline” formula for use in temporary spousal support. Alameda and Contra Costa counties have adopted the “Alameda Guideline” formula. The guideline states that the paying spouse’s support be presumptively 40% of his or her net monthly income, reduced by one-half of the receiving spouse’s net monthly income. If child support is an issue, spousal support is calculated afterchild support is calculated.

- Deciding permanent support is a much more detailed process with many factors to be considered. The controlling statute that the court must consider in establishing permanent spousal support states the following:

Family Code Section 4320. In ordering spousal support under this part, the court shall consider all of the following circumstances:

- The extent to which the earning capacity of each party is sufficient to maintain the standard of living established during the marriage, taking into account all of the following:

- The marketable skills of the supported party; the job market for those skills; the time and expenses required for the supported party to acquire the appropriate education or training to develop those skills; and the possible need for retraining or education to acquire other, more marketable skills or employment.

- The extent to which the supported party’s present or future earning capacity is impaired by periods of unemployment that were incurred during the marriage to permit the supported party to devote time to domestic duties.

- The extent to which the supported party contributed to the attainment of an education, training, a career position, or a license by the supporting party.

- The ability of the supporting party to pay spousal support, taking into account the supporting party’s earning capacity, earned and unearned income, assets, and standard of living.

- The needs of each party based on the standard of living established during the marriage.

- The obligations and assets, including the separate property, of each party.

- The duration of the marriage.

- The ability of the supported party to engage in gainful employment without unduly interfering with the interests of dependent children in the custody of the party.

- The age and health of the parties

- Documented evidence of any history of domestic violence, as defined in Section 6211, between the parties, including, but not limited to, consideration of emotional distress resulting from domestic violence perpetrated against the supported party by the supporting party, and consideration of any history of violence against the supporting party by the supported party.

- The immediate and specific tax consequences to each party.

- The balance of the hardships to each party.

- The goal that the supported party shall be self-supporting within a reasonable period of time. Except in the case of a marriage of long duration as described in Section 4336, a “reasonable period of time” for purposes of this section generally shall be one-half the length of the marriage. However, nothing in this section is intended to limit the court’s discretion to order support for a greater or lesser length of time, based on any of the other factors listed in this section, Section 4336, and the circumstances of the parties.

- The criminal conviction of an abusive spouse shall be considered in making a reduction or elimination of a spousal support award in accordance with Section 4325.

- Any other factors the court determines are just and equitable.

Question: How can I match DissoMaster's Child Support results to match DissoMaster(TM)?

Answer: First let's explore the key reasons the results vary from DissoMaster. Then, if you would like to match DissoMaster(TM), we will show how to do that.

Why Child Support Results Vary from DissoMaster

Assuming the data has been entered the same, here is one reason the results may be different..

DissoMaster is Treating Health Insurance Differently.The chart below shows how to match DissoMaster

DissoMaster is Treating Health Insurance Differently.The chart below shows how to match DissoMasterDissomaster Report

health insurance to Family Law Software health insurance, for employees:Dissomaster App

| Correct Tax Treatment | Family Law Software Tax Category | DissoMaster Data Entry Line | |

|---|---|---|---|

| Flexible spending account, cafeteria plan | AGI deduction -and- FICA/Medicare deduction | FSA, Flex, Caf, Etc. | Health insurance pre-tax wage ded |

| Other payroll deduction | AGI deduction only | Pay dedn-Not FSA, Flex | No correct equivalent found. This is the most common type of health insurance deduction, but our exploration found that DissoMaster either deducts from AGI and FICA/Medicare, or treats the payment as an itemized deduction. Closest would be: Health insurance pre-tax wage ded |

| Not payroll deduction (fully out-of-pocket). | NO AGI deduction. Deductible as Itemized deduction. | Medical | Health insurance wage deduction or Health Insurance paid by party |

If these options do not match, you can get different results.

For self-employed individuals, we believe that DissoMaster(TM) is using FICA in its calculation of Guideline Net Income, and we believe it should be using self-employment tax. The self-employment tax is actually quite complicated (you can follow it in detail on the 'more info' link next to the Self-employment tax line on View/Edit Taxes), and it is not the same as FICA employer portion + FICA employee portion.

To demonstrate that DissoMaster is using FICA when it should be using self-employment tax, do the following:

1. Enter self-employment income, but no wage income, as shown below:

2. Now click F7 for the Reports tab, and click on the Formal Report.

3. Scroll to the bottom. Here is what you may see:

Dissomaster App

Total Taxes of $57,722 is the sum of State Income Tax ($13,673) + Federal Income Tax ($39,618) + FICA ($4,431). However, it should be the sum of State Income Tax + Federal Income Tax + Self-Employment tax.

This is because self-employed individuals pay self-employment tax, not FICA tax. As DissoMaster never gives a correct result for self-employed individuals who pay health insurance, it is not possible to match this in Family Law Software.

How to Synchronize Taxes with DissoMaster

If the data has been entered the same, the most likely reason for difference in child support results is different tax calculations.

If you really want to use DissoMaster's (incorrect) tax calculations instead of Family Law Software's (correct) tax calculations, but then use everything else from Family Law Software, do the following:| 1. In DissoMaster, open the Formal Report. (From the top menu, Reports > DissoMaster report, then, in the Reports tab, along the right, Formal Report.) |

2. Find the entries for Federal, State and State Disability Insurance taxes, as shown below, and write them down for each party. Add the State and State Disability Insurance Taxes. |

3. Open Family Law Software. |

4. In Family Law Software, click Deductions > Support. |

5. On that screen, find the entries for Federal and State taxes, as shown below. |

6. Override the Family Law Software federal tax entry with that from DissoMaster. |

7. Override the Family Law Software state tax entry with the total of State Tax + SDI from DissoMaster. |

If you want to try to match the taxes, and you have an employee (not self-employed) who has no health insurance payments, or a flexible spending or cafeteria plan, you have a chance at matching DissoMaster without overrides.

First, if DissoMaster has not yet updated to current year taxes, you have to set Family Law Software back to the previous year. You can do that. In Family Law Software, from the list of links on the left, click 'More Reports.'

On the 'More Reports screen, scroll to the bottom and click the link for 'Start Year, Rates and Assumptions.'

Scroll down to the Start Year, and enter the previous year.

Please note by using prior year taxes, we are generating the wrong result in both software programs.

The next step is to compare the tax calculations. If you now have the same tax results in both programs, you are done, and most likely you will have the same guideline results.

If you do not have the same tax results, you can try to figure out why.

Here's how to compare the tax calcualtions in each program, line by line, to look for differences:| 1. In DissoMaster, turn Spousal Support off. This is so you can see what the tax calculations would be without Spousal Support. These are the tax calculations that are used for child support purposes. To turn Spousal Support off, click the button shown below. |

2. In DissoMaster, Open the Reports tab by pressing F7 or clicking, on the top menu bar, Reports > DissoMaster Report. |

3. In DissoMaster, on the Reports tab, at the left, open the Formal Report |

4. In DissoMaster, set the numbers to show Annually, and click the bar for Tax Forms, as shown below. |

5. Print the 1040 tax report. |

6. In Family Law Software, click the link on the left for View/Edit Taxes. |

7. Print the Family Law Software tax report. |

| 8. Compare the two reports line by line and look for differences. If possible, trace those differences back to the corresponding data entries in the two programs. |

Dissomaster

How to Synchronize Guideline Net Incomes With DissoMaster

Typically, matching DissoMaster taxes will bring the two programs into synch in terms of results.

If taxes are the same, but guideline net incomes are different, and you would like to try to figure out why, you can compare DissoMaster's Formal Report to Family Law Software's View/Print Guidelines > Worksheet.

Compare line by line. Where you see a difference, go back to the sources for each entry.

If there were overrides in either program, that might account for a difference..

If you do not want to figure out the reason for the differences, but you just want to use DissoMaster's calculation of Guideline Net Incomes for the two parties, you can just take DissoMaster's Guideline Net Income and pop it into Family Law Software.

This will use just the implementation of the guideline formula itself and should generate the same result in the two programs.

All of our tests so far have indicated that DissoMaster and Family Law Software have implemented the child support guideline formula the same way.

Here's how to pop the DissoMaster Guideline Net Income into Family Law Software.| 1. In DissoMaster, open the Reports tab and view the Formal Report (see the detailed instructions above). |

2. In DissoMaster, copy the bottom line of the Formal Report, labeled Net Guideline Income Before Support, as shown below. (Copy for both parties; only one party is shown below.) |

3. In Family Law Software, click View/Print Guideline > Worksheet, and scroll down to the line for Net Disposable Income, as shown below. |

4. Override the Family Law Software entries for both parties with the numbers you found in DissoMaster. |

The child support guideline result should now be the same. Again, if there were overrides in either program, that might account for any difference still remaining.